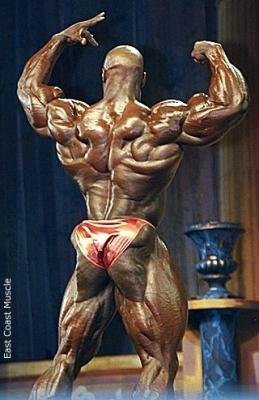

You may not know who Ronnie Coleman is but you do not have to be a bodybuilding expert to tell that Ronnie must know a thing or two about what it takes to make gainz. A few highlights of his career:

One of two bodybuilders to win 8 Mr. Olympia titles (the Super Bowl of bodybuilding)

26 major competition wins (2nd most of any bodybuilder)

Had a competition weight of close to 300 lbs (that’s a lot of muscle)

Beyond his near ridiculous physique, Ronnie is also known for lifting very heavy weights and his amusing self-motivating quips. My favorite is, “Everybody wants to be a bodybuilder but don’t nobody want to lift no heavy-ass weights.” Ronnie is telling us there is no shortcut to doing the hard work if you really want to get the outcomes you seek.

At Hard Yards, we like hard problems (it is in the name after all) and we are increasingly seeing one common hard challenge emerge with our clients. The topic of Portfolio Management comes up again and again. As organizations proliferate agile practices across the organization and seek to gain business agility, rethinking Portfolio Management practices becomes essential. We have found that the scope of Portfolio Management is typically much larger than our clients anticipate. Truly changing operating models to increase business agility requires a comprehensive approach to Portfolio Management that cascades from corporate strategy down to team level practices. It also requires lifting some serious “weight.” It requires making significant decisions and process changes with respect to organizational and team design, budget and finance practices, and creating tons of transparency. A lot of organizations are unwilling or unable to make these hard decisions. In other words, everybody wants to do Portfolio Management, but don’t nobody want to make no hard decisions (thanks Ronnie!).

To help with this problem, Hard Yards designed a workshop to help clients understand the full scope of Portfolio Management and accelerate implementation of new practices. We spend two days unpacking the theory of Portfolio Management and identifying the key decisions that need to be tackled in order to change the operating model. These decisions include the following:

What are the key strategic outcomes that the portfolio of investments will need to deliver? How, specifically, will we measure success?

How do we structure the portfolio? What are our swim lanes, value streams, categories of work?

How do we structure teams? How can we limit dependencies among teams?

What are the budget guardrails? What decisions can be made at various altitudes in the organization?

What is the process for going from idea to implementation and how can we limit work in progress to maximize agility and throughput (e.g. portfolio Kanban)?

How will we measure the outcomes for the work that flows through the Portfolio? How will we know that these practices are driving increased performance?

What are the events, artifacts, roles and responsibilities that make up our Portfolio Management activities?

As you can probably tell, the answers to these questions require a cross-functional team with representation from Technology, Operations, Business Line, and Finance leadership. Following the 2-day primer, we work with that group of leaders to map out an implementation roadmap and make some crucial initial decisions regarding portfolio design. The success of these workshops is absolutely dependent on having the right decision-makers included and the willingness and readiness to lift some heavy weight!

An example of one of these “heavy” decisions is aligning on design criteria for the portfolio itself. We have found that each organization has unique goals and dynamics that will influence how a portfolio is designed. For instance, a small technology startup with 500 people will have a very different design than a software shop for a Department of Defense agency. Here is an excerpt from our workshop that lays out the design criteria we ask leaders to evaluate during the early stages of portfolio design. Ideally, you’d satisfy all of these criteria, but the reality is that a tradeoff is almost always required. For example, it would be great to create our portfolio around value streams and have low decision latency and align our org chart and portfolio aligned. However, these typically represent hard tradeoffs and varying levels of change management challenges. We ask leaders to rank order these to drive clarity around why a given portfolio design is chosen.

It is a common mistake to assume that Portfolio Management only entails approving, tracking, and reporting on projects/initiatives. While this is certainly a function that Portfolio Management should cover, it is really just beginning. If the goal of a Portfolio Management implementation effort is to drive overall business agility, then many aspects of your operating model will be affected and then it will absolutely require a comprehensive approach.

If you are ready for Portfolio Management and willing to lift the heavy weight required to make it happen, we are here to help. Or, as Ronnie Coleman might say, “ain’t nothin’ to it but to do it.”

If you want to learn more about Portfolio Management, read our blog by Jim Kockler, where he go over valuable insights into designing a competitive innovative portfolio.